A review of 2023

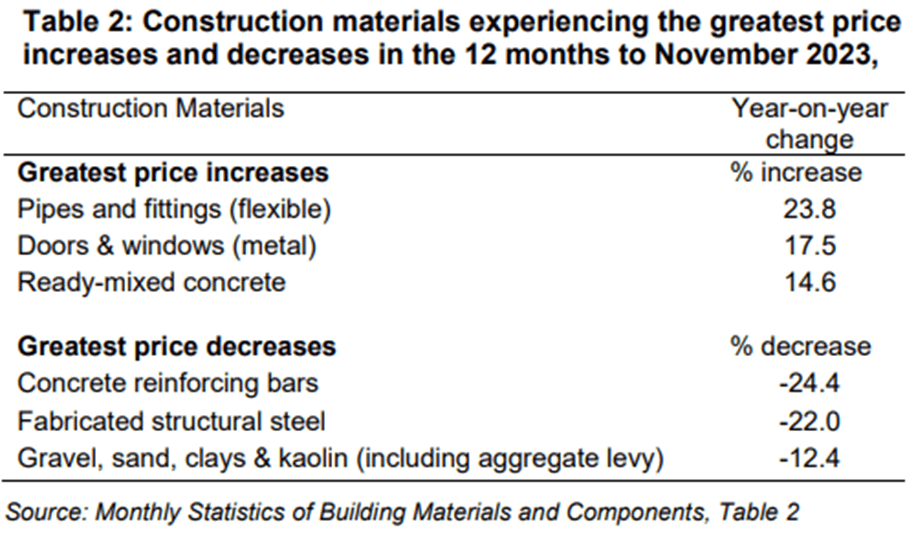

2023 saw a welcome reprieve from rising material costs. Whilst the start of the year retained the high prices seen in 2022, from the second quarter onwards, there was a steady decrease in some materials, predominately due to lower construction output and therefore demand – industrial output fell by 9% from Q3 2022 to Q3 2023. Steel and steel related products have seen the largest fall in cost, though ready mix concrete has continued to slowly increase, likely due to HS2. Although prices have fallen (see table below), the majority are unlikely to ever return to pre-COVID levels.

The fall in construction output also increased competition between contractors looking to secure future workload for 2024. Consequently, tender prices dropped, and this trend has continued into the start of the new year. Using the data that we have collected and benchmarked, for the industrial sector, we are anticipating a 3.5% drop going into Q1 2024.

Both factors combine to create a period of keen competitive construction costs for developers, though caution is advised when selecting contractors due to recent insolvencies, with Readie Construction looking to be the most recent contractor to succumb.

New challenges

In an industry that is ever evolving, several challenges are likely to impact cost:

- Biodiversity net gain (BNG) – a minimum 10% gain is required on all sites. As the majority of industrial sites have limited landscaping area, this may impact on the site efficiency by impacting the design, as well as off-site compensation costs.

- The impact of the Building Safety Act has yet to be fully realised (see our previous article for more information) with the regulations coming into effect on the 1st of October 2023, though warehouses are unlikely to fall into the higher risk category and therefore should have minimal if any impact on cost.

Predictions for the future

Market sentiment expects output to continue to fall or remain flat through 2024. Interest rates are not expected to drop significantly and the number of speculative developments has fallen. This could lead to further reductions in material and TPI, leading to even more competitive prices. Despite these headwinds, reports and analysis from both Knight Frank and Savills indicate an increased dependence on distribution and manufacturing, and potentially a 7% rise in online sales. On balance, Goodrich is cautiously optimistic that 2024 will be a strong year as the industry continues to build momentum from 2023.